Reacting Forward (1): The Process of Incorporation

“Remote shopping, while entirely feasible, will flop.” — Time Magazine, 1966

The Incorporation Process

The first time is always the more complicated. There is some jargon to understand, and a few answers to questions to figure out. After that every time you do this it becomes a ‘fast and no-brainer’ sort of process.

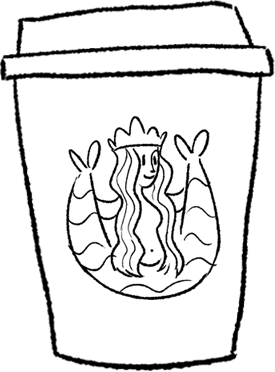

Decision 1: Company Name

Many people drive themselves crazy trying to come up with a catchy name for their company. There is also an army of experts willing to relieve you of your life savings to help you come up with it. When you think about it, the name of a company rarely convinces a customer to purchase a product or service. It’s the successful product or service that usually makes the company a household name, and achieves critical repeat business. If you experience a lousy product or poor service, the chances of you going back for more are negligible, irrespective of the company name.

Do you use post-it pads because the manufacturer is called 3M?

3M has created an image of innovation and quality. Their logo is instantly recognizable despite the fact the actual company name (Minnesota Mining and Manufacturing) has little to do with their current business concept, or your sticky notes.

Do you drink Starbucks coffee because the name inspired you? In 1971 the founders got together with artist Terry Heckler to define the brand and came up with the name. How? Starbuck was the first mate of the ship Pequod in Moby-Dick. On the Starbucks website there is an explanation, but it would take a genius to figure out its derivation otherwise.

I suggest that rather than getting stressed about a catchy company name, you instead put your energy into creating a great idea, and then providing a product or service second to none.

A good company name is perhaps more important if your business is providing a service. The name should at least reflect what you do so that it’s easy for potential customers to recall whenever they need that service.

For instance, who can deny Paypal describes itself perfectly? You might be surprised to learn, however, that it did not start out as Paypal. In 1998 Peter Thiel and Max Levchin founded Field Link, which was soon renamed Confinity. A year later Confinity launched the first version of the PayPal electronic payments system. Confinity was acquired by X.com Corporation and for their initial offering of stock on NASDAQ the firm was renamed PayPal Inc.

In 2002 eBay Inc. acquired PayPal for $1.5 billion in stock. A four-year American dream if ever there was one. Interestingly, Ebay was originally called Auctionweb. Having weak original names did not stop either company from succeeding. In 2018 Paypal became an independent entity again.

It does not cost anything to change a company name later, and you do not have to go through another incorporation process. If the name changes, you simply update the information online. The Secretary of State website will record it as Company X, D/B/A (doing business as) Company Y.

When I first incorporated an idea I went with the uninspiring name TGB International (TGB being my initials and “international” because there is a magic in thinking big). Then when I started my first company I changed the name from TGB International to QOL Medical. QOL is an acronym for quality of life, which better reflected the purpose of the company. We became probably the smallest international company in the pharmaceutical business with customers in Europe and Asia.

For my own companies, I spent zero dollars and less than five minutes coming up with the names. When I die I doubt anyone will remember them. Even though, the companies made a positive difference in people’s lives with excellent products and sophisticated customer service. That’s what matters.

Here are some basic tips, but don’t sweat it, as there are as many exceptions to the rules. Companies with great names like Circuit City fail just as much as ones with nonsense names like Flooz.com. Who can say that Amazon.com Inc. makes any sense as a company name, but it has hardly mattered to their success. I’ve heard management consultants wax lyrical about the brilliance of the Amazon.com Inc. name. The truth is Bezos came up with it on the fly. He wanted a name that was at the head of the alphabet so it would show up first on list services.

- Make it somewhat relevant to your product or service.

- Trust your instincts. If it feels right to you, go with it.

- If your instincts are not strong at the moment, take a plain piece of paper and just start scrawling out words and names. Eventually, something on the paper pops out at you as if it is written in bold or colors. Go with it.

- Do not waste time and resources, especially cash, by hiring someone to do this for you.

Decision 2: Choosing a Corporate Structure

Here is all you will ever need to know about corporate structures, along with some personal recommendations.

1.) General Corporation: Keeping in mind that more than 90 percent of small businesses are not incorporated, a general corporation, also known as a C corporation is the most popular corporate structure in America. This structure allows as many shareholders as you want and is more typical of large public companies. You, however, are not starting out as a corporation but a non-employer startup. This is not for you yet.

The problem with the C Corporation is double taxation, first at federal level and then at state level. After that, you will get taxed on any profit distributions both at federal and state levels.

2.) Close Corporation: Shareholders are limited in number to 30. Not all states recognize close corporations, so most virtual businesses will choose an alternative structure.

3.) Subchapter S Corporation: A Subchapter S company is a general corporation that has a special tax status with the IRS that permits business owners and entrepreneurs to be taxed as if they were still sole proprietors. S Corporations avoid the double taxation of a general corporation but there are some restrictions to ownership. Only citizens or permanent residents of the United States can be involved and the shareholder limit is set at 75. Other restrictions make it a complicated structure for a virtual business.

S Corporations add a complexity to your small business that is distracting, especially if you intend to be the sole owner at first.

4.) Limited Liability Company (LLC): This is not strictly a corporation, but many small business owners and entrepreneurs prefer LLC because they get the limited liability protection of a corporation with the “pass through” taxation of a sole proprietorship. Every state recognizes the structure and there is greater flexibility in how they can be organized and managed.

They are so simple and inexpensive to set up. All my companies have been LLCs, a structure unique to the USA. (SE company in Europe) (Individually owned company in China)

In Canada, LLCs don’t exactly work that way. Understanding the differences between an LLC vs. a corporation in Canada is an important consideration to make because, in Canada, LLCs receive all the same classifications as corporations. Although differences exist in other countries, such as the United States, these differences don’t apply to Canada.

This means, tax exceptions or protections for personal assets that exist under typical LLC laws don’t apply either. While you may be able to convert an existing LLC from another country into an LLP in Canada, for example; LLCs are not typically formed in Canada. Instead, you can form a corporation in Canada.

There are three main types of partnerships in Canada:

General partnership: A general partnership is a business agreement between two or more parties that grants each partner his or her own share of ownership in the business.

Limited partnership: This type of partnership allows some members of the partnership to have special tax benefits and an operating agreement that details the investment allocations, capital contributions, and management responsibilities among the partners. In this partnership, some partners still have full liability for the business.

Limited liability partnerships: LLPs protect all partners from liability and in most provinces, LLPs are only available in high-risk industries, such as law, accounting, architecture, or medical care. Provincial legislation governs LLPs, and the protection from liability provided differs based on your province or territory.

Decision 3: Filing paperwork

All new LLCs must file so-called articles of organization with their secretary of state’s office. That sounds intimidating, but it is just a short form you fill out online that asks for the names of the LLC and its members, and their contact information, and it is part of the same online process.

As a non-employer you would also be the ‘Single-member.’

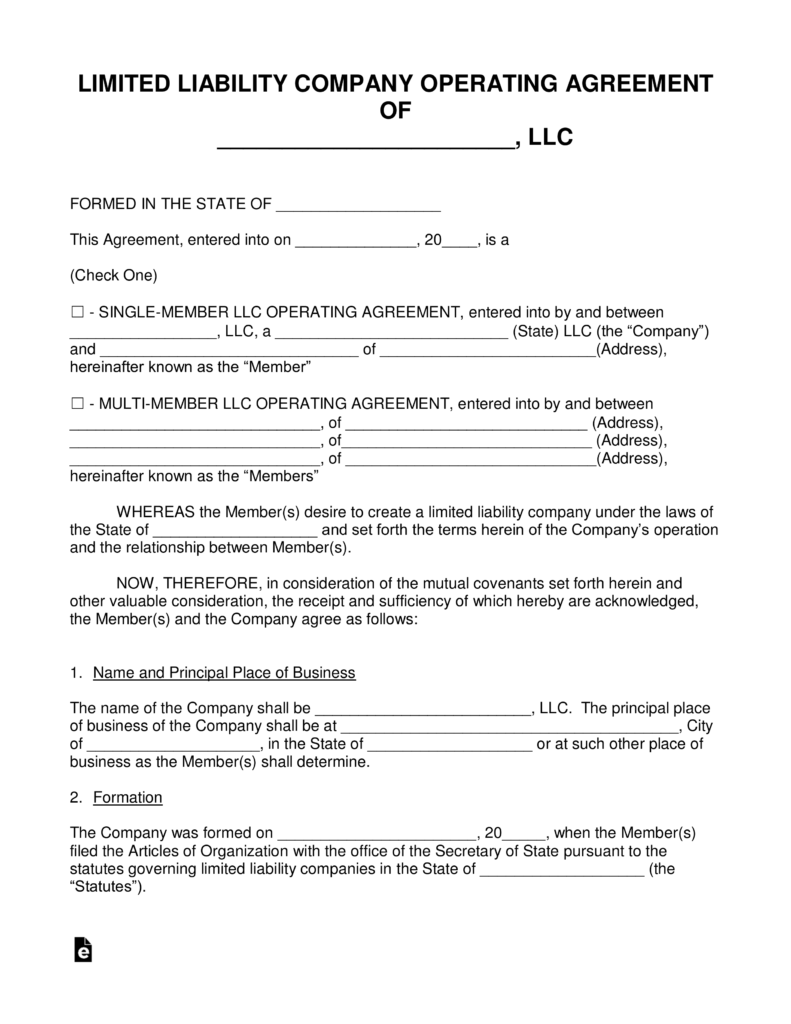

Here is an example:

Although, often not required by law, you will be offered the chance to draft an operating agreement for your LLC that spells out the details of the business arrangement, including members (you and any other shareholders) percentage ownership, roles, rights, and responsibilities. The online service does the work for you and you just need to fill in names and mailing addresses. Having such an agreement can help protect the LLC structure if it’s challenged in court and prevents you from having to default to state operating rules. Because you are likely the sole owner, it seems an unnecessarily complex step, but laws are laws, so just point and click away. Yes, even this seemingly complicated task is handled in the same point and click session online. If you intend to seek a loan for external sources, the lender will typically want to have an operating agreement for your company on file.

Decision 4: Registered Agent

You are required to have a registered agent in the state of incorporation. It sounds complicated, but a registered agent is simply someone who is available during normal business hours to receive legal and tax mail if there are any. Most non-employer entrepreneurs would select themselves as the registered agent, which avoids all cost. Paying for a registered agent at the start is a bit dumb. Be aware that some online services offer to be your registered agent. Don’t fall for it.

Of course you can make your home address your place of business. However, I prefer to use a more formal postal address as the place of business. There are dozens of companies online that can provide this service for you. The one I use will open and scan mail to my inbox. That way, I can access mail wherever in the world I happen to be and my company remains permanent at my postal address.

So, long as you have a physical address in the state of incorporation, you can make yourself the agent. When the question comes up online, enter that name and address.

Then, once a year the license renewal arrives by email with instructions about how to renew online and you never have to remember. You will also receive occasional letters about employee taxes, worker’s compensation and the like. The non-employer business model, however, has no employees, so these bulletins usually go to the trashcan. What could be simpler?

Formally structuring your business does one other major thing for you—it portrays the appropriately professional company image. It allows you to call yourself a Chief Executive Officer of a real business and that’s an ego boost for anyone.

Homework Time

Okay, it is time to confess. Did you do it yet? Still procrastinating? Really? Are you serious about entrepreneurship or not?

Wake up.

Those of you who understand the importance, please share your experiences and tips and hacks for everyone else who thinks they know better than the teacher.

Resources

This might seem a bit off topic, but actually what you are doing by incorporating an idea is committing to accept change in your life. In this video, I am teaching the commitment to change ritual, which is a vital part of the equation used for achieving any Intention. You can learn more about the rest of the equation inThe Transformation Experience.

Day 2 of the same presentation.